Protecting duty payer's rights at the time of FTA origin verification

HOME

BusinessesProtecting Duty Payer's RightsProtecting duty payer's rights at the time of FTA origin verification

Rights of Duty Payers in FTA Origin Verification

You may get help from Experts.

The person subject to a spot investigation necessary for verification of country of origin may have lawyers or customs brokers attend the investigation or make their statement.

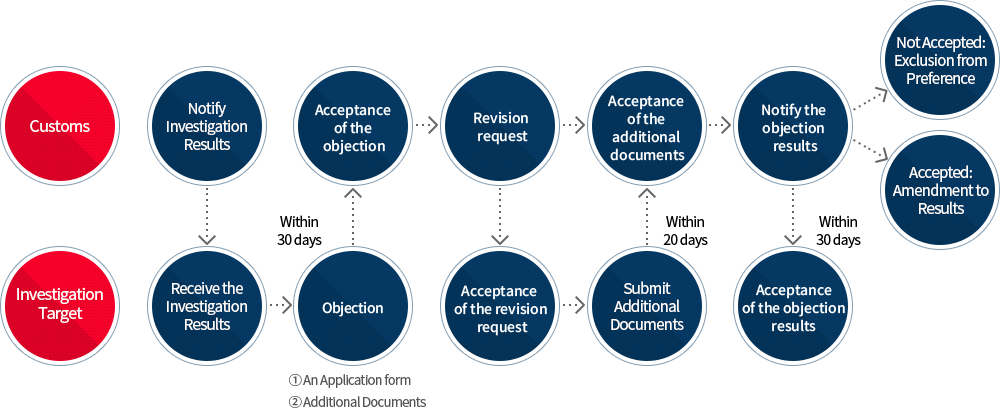

You may object the results of origin verification

- An investigation target (exporter, producer or importer) who disagrees with the results of a country of origin investigation may file an objection to the Commissioner of the Korea Customs Service or the head of the customs within 30 days from the date of notification of investigation results.

- When there is an objection, the Commissioner of the Korea Customs Service or the head of the customs shall examine the case, and notify the results to the applicant within 30 days.

- Where the details or procedures of the objection are deemed inappropriate or to have room for revision, the Commissioner of the Korea Customs Service or the head of the customs may request revision with a fixed period of no longer than 20 days.

Required Documents for Objection

- 1 An application form for objection

- 2 A document with the name, address or place of residence of the applicant

- 3 Date of notification of investigation results and the investigation results

- 4 The description, standard, usage, and the exporter, producer or importer of the goods

- 5 Main points and the details of the objection

You may Appeal to the Results of Origin Verification.

- A duty payer may apply for remedies (appeal) against any measures taken based on the results of origin verification in the following ways:

A duty payermayapply for remedies (make an objection) Types of Request Period Head of the Office of Review Office of Review (Committee in Charge) Pre-Taxation Review Within 30 days from the date of pretaxation notice Head of the customs or the Commissioner of the Korea Customs Service (when at least KRW 500 million is charged) Customs Appeal Committee Request for Examination Within 90 daysfrom the date of notification of Disposition Commissioner of the Korea Customs Service Customs Appeal Committee Request for Adjudication Within 90 days Chairman of the Tax Tribunal Tax Tribunal Judge Council Examination request to the Board of Audit and Inspection of Korea Within 90 days Chairman of the Board of Audit and Inspection of Korea Audit Committee

For More Information

Korea Customs Service, Origin Verification Division, 042-481-3213