Import Clearance

What is import ? (Clause 1, Article 2 of the Customs Law)

An import refers to the carried in foreign goods into Korea (those which have gone through the bonded area refers to the carried in items from the bonded area) or those consumed or used in Korea including ones used or consumed within the means of transportation in Korea. According to Article 239 of the Customs Law, the goods which pertain to the consumption or the use that do not meet the criteria for import are exceptions.

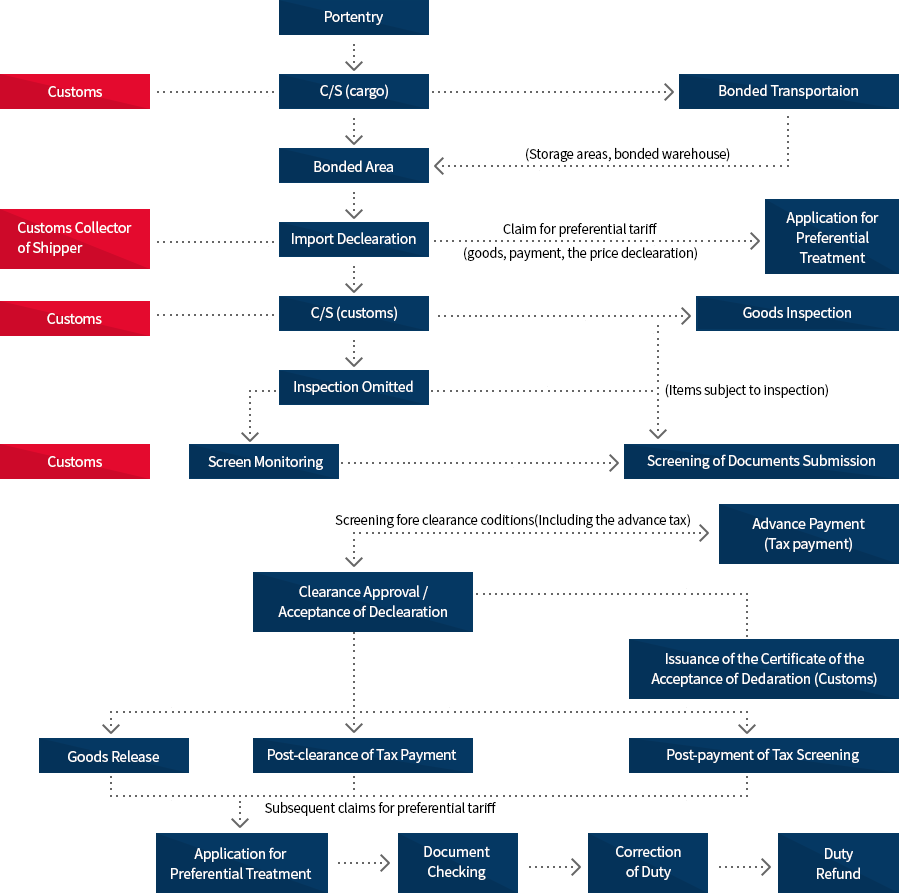

Flow chart of import clearance procedure

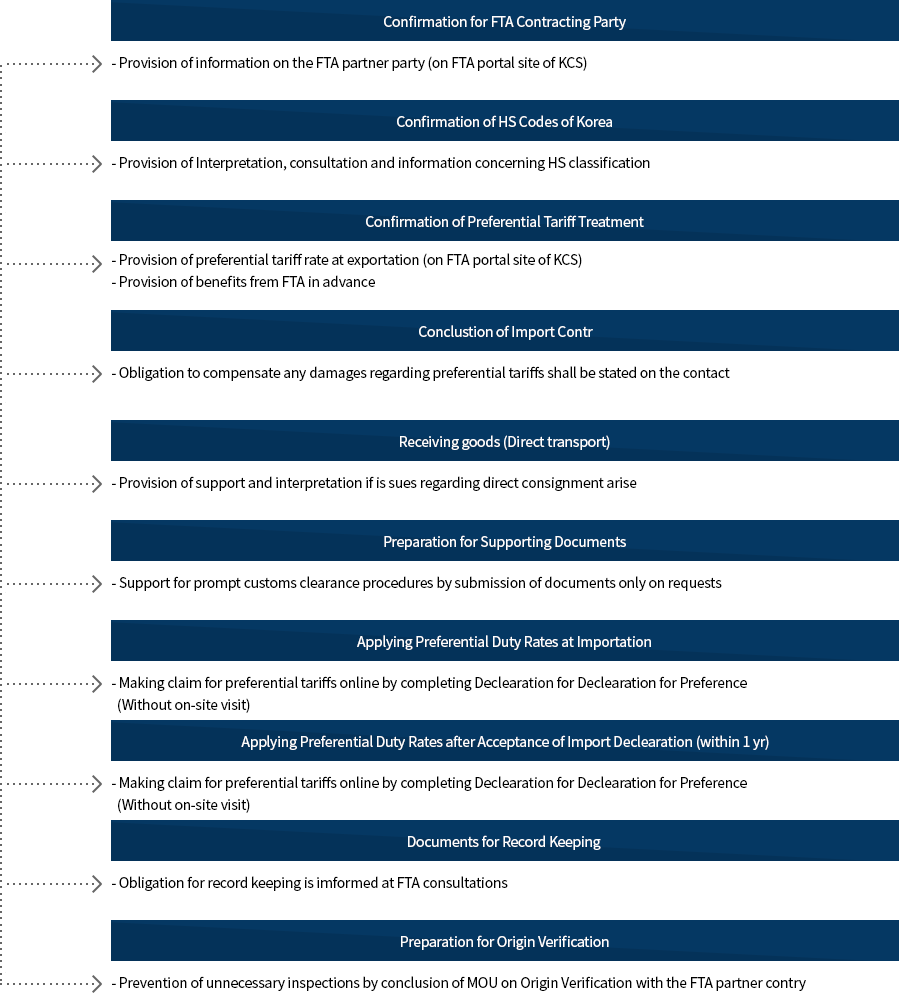

Import Clearance Procedures under FTA

- Confirmation for FTA Contracting Party

- Provision of information on the FTA partner party (on FTA portal site of KCS)

- Confirmation of HS Codes of Korea

- Provision of Interpretation, consultation and information concerning HS classification

- Confirmation of Preferential Tariff Treatment

-

- Provision of preferential tariff rate at exportation (on FTA portal site of KCS)

- Provision of benefits frem FTA in advance

- Conclustion of Import Contr

- Obligation to compensate any damages regarding preferential tariffs shall be stated on the contact

- Receiving goods (Direct transport)

- Provision of support and interpretation if is sues regarding direct consignment arise

- Preparation for Supporting Documents

- Support for prompt customs clearance procedures by submission of documents only on requests

- Applying Preferential Duty Rates at Importation

- Making claim for preferential tariffs online by completing Declearation for Declearation for Preference(Without on-site visit)

- Applying Preferential Duty Rates after Acceptance of Import Declearation (within 1 yr)

- Making claim for preferential tariffs online by completing Declearation for Declearation for Preference(Without on-site visit)

- Documents for Record Keeping

- Obligation for record keeping is imformed at FTA consultations

- Preparation for Origin Verification

- Prevention of unnecessary inspections by conclusion of MOU on Origin Verification with the FTA partner contry